PHARMACIES ARE CLOSING DOWN – WHO IS RESPONSIBLE?

Who’s to Blame for the Collapse of Pharmacies?

This newsletter is just my opinion. It might not be 100% correct; I know for sure that it is not 100% correct, but it’s what I know—and I’ve lived this and several other businesses.

Although this Newsletter appears to be geared toward pharmacies because that is the focus, it is actually addressed to any small or even midsized businesses in the United States.

Pharmacies are closing everywhere, and PBMs are the obvious targets. But they’re not alone. Others—some of them posing as allies—contribute to this mess and benefit from your losses.

In these tough times, anything and anyone that costs you money but doesn’t make you money is a threat.

So, who’s really on your side? Here’s the cold, hard truth: YOU—and only you.

Why You Should Listen to Me or maybe you shouldn’t!

I don’t have any pharmacy business left to lose. I built them, consolidated them, and sold them at their peak.

Pro tip: The best time to exit a business is when you don’t have to—not when you’re forced to.

How I Went From a Pharmacy Rookie to a Global Entrepreneur—and What’s Killing Pharmacies Today

In 2010, I bought my first pharmacy in downtown Baltimore. No business background, no MBA—just years of experience working in big-box chains. The pharmacy was so small that it came with exactly one part-time technician. During the day, I ran the pharmacy; at night, I painted walls, fixed doors, and patched drywall. My wife and I moved into the apartment upstairs with our two sons—and one daughter on the way.

But don’t cue the violins. That scrappy little pharmacy became the foundation of a global enterprise. This story isn’t about hardship but about seeing threats, making bold moves, and knowing when to adapt.

You’ll notice two recurring themes in my story—and, frankly, in my advice. They might surprise you, but they’re essential for making bold moves and hitting the ball out of the park.What are they? Ignorance and Arrogance. Yes, you read that right.

These aren’t flaws—they’re tools. The right dose of ignorance helps you ignore the naysayers, and just enough arrogance gives you the confidence to swing for the fences.

A Ranking of Threats: From Subtle Nuisances to Real Villains

This list of threats to your pharmacy is based entirely on my experience. It’s not just a random ranking—it’s carefully ordered by intensity. At the top of the list are the less harmful players, those who might appear as nuisances in the grand scheme. But as you move further down, the gloves come off, and the real villains are revealed.

Now, let me be clear: some of the names on this list aren’t inherently threats. In fact, under the right circumstances, they can be great allies. In a healthy pharmacy market—where margins are strong, reimbursements are fair, and owners are thriving—these players can provide vital support.

- Marketing firms can help grow your customer base.

- Consultants can offer strategies to optimize operations.

- PSAOs and GPOs can negotiate better contracts on your behalf.

- Even wholesalers play a crucial role in keeping your shelves stocked efficiently.

However, we’re not talking about “healthy pharmacies” here. We’re not speaking to owners enjoying strong cash flows and a leisurely weekend off.

I’m talking to you—the pharmacy owners who are barely keeping their heads above water. For you, in these tough times, all of these names—every single one—can pose a threat to your survival.

Why Are They Threats Now?

In the current pharmacy world, anything that costs you money but doesn’t directly make you money is a threat. And when your margins are razor-thin, even the smallest inefficiencies or unnecessary expenses can feel like a death sentence.

- Marketing, Media, and Advertisement Companies can drain your budget without delivering measurable results.

- Consultants might offer advice you can’t afford to act on.

- PSAOs and GPOs could prioritize their group’s interests over your individual success.

- Wholesalers might negotiate deals that look good on paper but are impossible to optimize without significant effort.

- And of course, PBMs—they don’t just nibble at your profits; they devour them.

A Warning for Struggling Pharmacies

If you’re struggling to stay afloat, treat everyone in this list as a potential threat until proven otherwise.

This doesn’t mean you should cut ties with all of them or mistrust everyone you do business with. It means you need to:

- Scrutinize every partnership, every expense, and every promise.

- Ask hard questions: How does this help me? How does this increase my revenue or decrease my costs?

- Remember that even “partners” can unintentionally (or intentionally) add to your burden if they aren’t aligned with your immediate needs.

A List for Tough Times

This list is a survival guide for the pharmacy owners fighting to keep the lights on. In better times, some of these names might be the lifelines that help you thrive. But in today’s pharmacy landscape, treat them as potential threats until you can evaluate them clearly.

Stay sharp, stay skeptical, and stay afloat.

The Threat List: From Missteps to Malice

- Marketing, Media, and Advertisement Companies

- Consultants

- PSAOs and GPOs

- Drug Wholesalers

- PBMs

- You

You Hold the Keys

Here’s what I’m saying upfront: Don’t overanalyze this newsletter. Read it, take action, and move on. I’ll be doing the same—focusing on my global ventures and leaving the blame game behind.

Stay with me. This isn’t just a rant—it’s a roadmap. And it starts by asking yourself the hardest question of all: Are you ready to face the real problem?

Marketing, Media, and Advertisement Companies: The Dance of Growing (or Not Growing) Your Business

Like most small business owners, I initially got caught up in the dance of “growing” my business through marketing. I hired a few firms, spent money on Google ads, built a shiny website, and even commissioned professional photos. One of those photos became the face of my business—polished, perfect, and completely irrelevant to my bottom line.

And then? I never bothered with another professional photo. Or another ad campaign. Why? Because I realized something critical: I was spending time and money I didn’t have to bring in traffic I didn’t need.

Fix Your Ratio Before You Burn Cash

The problem wasn’t the marketing itself—it worked, but only a little. It brought me pennies when I needed dollars.

The real issue was my Gross Revenue vs. Owner’s Discretionary Income ratio.

If that ratio is “risky”—meaning your income is barely covering your costs—why would you spend more money to attract more traffic? You’re essentially adding more risk to an already precarious situation. And if you’re spending money without a clear ROI, you’re not just gambling with your business—you’re gambling with your team’s livelihood.

Family Comes First

Think of your business as a family—your immediate family and your work family. Your first responsibility as a leader is to make sure everyone at the table has enough to eat.

Sustain what you have going on, optimize what you have, and only then can you afford to “grow” your business without starving the family that keeps it running.

Stop the Dysfunction: Your Technicians Aren’t Social Media Managers

Now, let’s talk about one of the biggest dysfunctions I see in pharmacies: turning your pharmacy techs into makeshift Facebook managers.

It might look cute from a distance. “Oh, look, we’re engaging with customers on social media!” But it’s not cute—it’s a sign of dysfunction.

Your technicians didn’t apply to be digital marketers.

They came to work to support your business by being great at what they’re trained for—pharmacy work. When you turn them into part-time social media managers, you’re not only distracting them from their primary role—you’re also creating a morale problem.

Bold Truths About Marketing

Here’s the thing about marketing: it’s not magic. You can’t just throw money at it and expect your problems to disappear. The most successful marketing happens when you have a solid foundation—when your business is profitable, your processes are efficient, and your team is focused.

If your foundation is shaky, marketing is just lipstick on a pig. And guess what? The pig is still broke.

The Cynical Leader’s Guide to Marketing

Let me be blunt: stop spending money to market a business that isn’t making you money. You’re not an influencer; you’re a pharmacy owner.

Instead, focus on getting your business into a place where every dollar you invest—whether in marketing, operations, or expansion—returns two dollars (or more). And if you must do some marketing:

- Keep it simple and low-cost.

- Don’t let it become your team’s day job.

- Showing up in a few pictures, blogs and podcasts is not a gift card for the grocery store.

- Always ask: “What’s the ROI?”

CONSULTANTS: Saviors or Smoke-Sellers?

In recent years, consultants have been crawling out from under every rock, each one armed with “secrets” to unlock higher revenues and profits for your pharmacy. To their credit, many provide genuinely valuable information, and some even tell you the truth.

But let’s be clear: it wasn’t knowledge that got you into your current situationit was a lack of resources to execute.

The best advice I ever got? It didn’t come from a consultant I paid—it came from an exchange where both parties brought value to the table.

Ask Consultants the Right Questions

When a consultant pitches you their next big idea, don’t just nod along. Ask them:

- Can you execute on this plan, or are you just here to advise?

- Do you have resources to help me implement this, or am I left to figure it out alone?

- Are you connected with reputable firms who can get this done for me?

- How many businesses have you actually built, operated, and sold yourself?

- Can you help negotiate my finance rates from the bank who lent me money to buy this business – frankly, I don’t think so.

Renegotiating Your Lease: A Classic “Great Idea” That Misses the Point

Here’s a common consultant suggestion: “Renegotiate your lease.” Sounds practical, right? Well, let’s do the math:

- Pharmacy Size: 3,000 sq. ft.

- Current Lease Rate: $20/sq. ft. = $60,000/year ($5,000/month)

- Negotiated Rate: $17/sq. ft. = $51,000/year ($4,250/month)

Savings? $750/month.

Now, is that worth it? Sure, it’s $750 in your pocket. But what if you’re already losing over $750/month in mismanaged labor or underutilized resources? The lease savings might feel good, but it won’t fill the financial black hole caused by inefficiencies elsewhere.

$750 Drug: I can go on and on about how you can lose $750 monthly. How about that one of the $750 dollar drug which was returned to stock by your technician, it sat on the shelf for a few months while you lost an opportunity to return it. It happened because you missed it, you missed it because you needed a system or highly trained individuals who were looking out for this.

$750 Audit: You will lose multiples of 750 dollars in an audit because you did not have (1) A pre-audit – self-audit system in place, (2) even if there was a system, then there was NOT enough Women/Men power to run your process.

Switching Your Energy Provider: A Drop in the Bucket

Another gem of advice you might hear: “Switch from Sprint to Verizon or vice versa,” or negotiate down your energy bills. These changes might save you a few hundred dollars a month, but they won’t move the needle on the larger problems threatening your pharmacy’s survival.

Clinical Services: Good Idea, Wrong Timing?

Clinical services are another popular consultant recommendation. I won’t argue the potential—it’s there. But is this the right time for most pharmacy owners? Probably not. Here’s why:

Establishing a clinical service business requires:

- Training yourself and your staff.

- Writing a business process flow (preferably using ISO and LEAN standards).

- Marketing this service to referral sources.

- Perform billing and accounting.

- Be ready to handle the Revenue Cycle Management issues

- Be ready for denials and to reply to those denials

- Bring the patient into the practice, but first, bring them on the call

- This means establishing a small size call center with trained professionals

Ask your consultant: Can you provide training? Can you help design a solid process? Can you source skilled labor to execute this plan at an affordable cost? Can you set up a call center for patient outreach? Can you?

Most consultants will shrug and say, “That’s your job.” Some might tempt you with the promise of offshore labor at $5–$7/hour, but let me tell you the truth:

No highly organized, sophisticated firm anywhere in the world is giving you $5–$7/hour labor, which can produce profesisonal results.

Yes, you’ll find fly-by-night operations offering these rates, but do you really want to entrust sensitive patient data and your business’s sustainability to them?Ask these consultants if their recommended offshore firm has ever owned or managed pharmacies—or, for that matter, any business in the U.S. Odds are, the answer is no.

The Good, the Bad, and the Bold

To be fair, consultants aren’t all bad. The good ones can bring clarity, strategy, and fresh ideas to your business. But their advice is only as valuable as your ability to act on it.

“Remember: a consultant should be more than a PowerPoint warrior”.

PSAOs and Buying Groups: Partners or Predators?

When it comes to PSAOs and buying groups, the story is always the same:

“ABCD group offers WAC minus this, while XYWZ group has a better deal with Optum.” “One group offers better insurance contracts, but another has superior vendor discounts.” “This PSAO provides audit defense!” (Newsflash: no one can defend you if your processes aren’t up to par.)

This is the song I heard throughout my years owning pharmacies. Sure, some PSAOs and GPOs have territorial advantages, but their true loyalty lies not with you—but with the strength of their group’s purchasing power.

Let’s explore what they bring to the table, what they take from it, and why some of their “brilliant” ideas might leave you wondering if they’re helping you—or feeding you to the wolves.

The CGM Conference Debacle

A few years ago, I attended a PSAO/GPO conference where a firm presented a groundbreaking idea for Continuous Glucose Monitors (CGMs). Here’s how their pitch went:

- Pharmacies aren’t equipped to process, ship, and bill for CGMs.

- So, pharmacies should send the Rx to our third-party company.

- We’ll handle processing, shipping, and billing.

- The pharmacy keeps the patient and their satisfaction, and everyone is happy!

Sounds great, right? Wrong.

Here’s what would happen: I fill the retail prescription for the patient, losing money in the process. Then, the CGM—my one chance to make a decent ~$90/month, practically forever—goes to someone else. And all I get is a pat on the back for keeping the patient happy.

Worse still, pharmacy owners were applauding this deal as if the PSAO/GPO management had just discovered fire. Meanwhile, I couldn’t stop thinking about how much this arrangement shortchanged pharmacies. Instead of helping pharmacies build the infrastructure to process and bill for CGMs themselves, the PSAO invited a third party to profit off their members.

They could have supported the pharmacies by arranging for credentialing, contracts with CGM manufacturers, distribution and drop-shipment agreements, and revenue cycle management. But they didn’t. They brought in a middleman to feast on what should’ve been our meal.

PSAOs and GPOs: The Value They Bring—and the Price You Pay

Don’t get me wrong—PSAOs and GPOs do bring value. They’re hardworking groups that negotiate on your behalf, mostly securing better-purchasing terms than you could alone also, better insurance contracts. But let’s be clear:

- They’re in it for themselves. If your business strengthens their direct purchasing power, they’re happy to have you around. That is why they commonly don’t encourage a hybrid pharmacy model (retail and LTC).

- They focus on their priorities—not yours. They won’t encourage or support ventures that don’t directly benefit their bottom line, even if those ventures could significantly improve your profitability.

That’s not to say all PSAOs are alike. Some genuinely think outside the box and bring innovative opportunities to the table. But most stick to strategies reinforcing their purchasing strengths—because that’s their bread and butter.

The Takeaway: Don’t Be the Main Course

PSAOs and GPOs often position themselves as your biggest allies. Be skeptical of “brilliant” ideas; look for partners who align with your goals, not just their own.

Because if you’re not careful, you might find yourself served as the main course at their banquet of profits.

Drug Wholesalers: The Casino Dealers of Pharmacy Business

I’d like to think I’m decent at math. (And let’s be honest—by looking at my name and my picture, you probably assumed I’d be good at it anyway 😊). But jokes aside, my math skills were put to the test when I landed my first pharmacy, complete with a whopping ½ FTE of a technician. I thought I could use my number-crunching abilities to decode the mysteries of drug purchasing.

Spoiler: I failed a few times. Wholesaler agreements are not for the faint of heart. So, I did what any struggling entrepreneur would—I sought the wisdom of the elders, those who had been in the Baltimore pharmacy trenches for decades. Slowly but surely, I started to get the hang of buying.

Here’s what I learned: there’s money to be made in the buying process, but getting there requires so much time and effort that it’s like playing blackjack in a casino. The house (read: wholesalers) stacks the odds against you. Sure, you can optimize a deal, but the resources you’ll pour into it will leave you too drained for anything else. That’s how the game is designed.

The Harsh Reality of Wholesalers

If wholesalers are truly “on your side,” why can’t they just lower drug costs or offer better invoice terms when you’re struggling?

They won’t—because sharing losses isn’t in their business model. While they may shed a tear for your plight, they won’t open their wallets to help.

This realization led me to a simple decision: instead of killing myself over Metformin discounts, I shifted to businesses with much better Gross Revenue-to-COGS ratios.

What do i think you should do?

If you’re a pharmacy owner, here’s my advice:

- Be Cautious but Strategic: Buy your drugs wisely, but don’t let the process consume you.

- Leverage Systems and People: Invest in technology and talent to manage the heavy lifting of purchasing. You don’t need to analyze every invoice or haggle over every discount personally. Hire performers who can handle the nitty-gritty while you focus on the big picture.

By the way, you cannot afford these performers in your region, wherever you are in the United States. The cost will become prohibitive very fast; you need to (must) go offshore to find them but find a solid firm that is deeply rooted in the United States as well as in another country.

Remember, the key isn’t fighting the system—it’s outsourcing the battle to someone who knows how to win it for you. Let the experts deal with the “casino” so you can focus on playing a game you can actually win.

PBMs: The Masters of the Rigged Game

The PBM game has been in full swing since the day PBMs were born. And let’s face it, if any of us owned a PBM, our business model wouldn’t be all that different: maximize Accounts Receivable (payments from employers or systems) and minimize Accounts Payable (payouts to vendors, like pharmacies).

It’s Business 101, right? Except, somewhere along the way, PBMs pushed the envelope so far that their practices now flirt with—or outright cross—criminal lines.

Cracking the PBM Code

From my first exposure to PBMs, I knew something didn’t smell right. I watched as coalitions formed, buying groups sent urgent notices about what to sign (or not sign), and town hall meetings buzzed with anxiety.

I learned how to manage the PBM game at some level, and you know what? It worked—kind of. My business was steady, and I was making ok money. But the cost?

PBMs: The Cost of Playing the Game

Here’s the catch: making money in the PBM world came at the expense of my sanity. It demanded constant vigilance.

If I was on the bench, things stayed afloat.

If I stepped away, even briefly, the whole operation risked hemorrhaging money.

Building a team that could match my level of alertness was impossible.

The Pivot: Finding Better Business Models

Realizing that PBMs’ razor-thin margins weren’t worth the stress, I shifted my focus. I looked for models where the delta between Gross Receivable and Gross Payables left room to breathe—and grow.

Here’s where I landed:

- Large Clinic Referrals: Partnering with clinics for steady, high-margin business.

- Hospital-Based Cash Compounding: A niche with significant upside, free from PBM games.

- Multistate DME Dispensing Models: Durable Medical Equipment offered consistency and profitability. The licensing restrictions are not as choking as pharmacy business.

- Workers’ Compensation Dispensing: A segment that rewarded precision and efficiency. Drugs workers comp but mostly DME workers comp.

PBMs: A Cautionary Tale

Here’s the thing about PBMs: they aren’t just challenging—they’re designed to wear you down. Their rules are complex, their margins are tight, and their demands are relentless.

PBMs aren’t going anywhere for sometime. But maybe you can.

YOU: The Biggest Threat to Your Business

Let’s rip the Band-Aid off: the largest threat to your pharmacy isn’t PBMs, wholesalers, or consultants—it’s YOU.

If you’re like most pharmacy owners, you spend your days switching hats, juggling tasks, and patting yourself on the back for how “busy” you are. But here’s the ugly truth: You’re so busy trying to survive that you’ve forgotten how to thrive.

And the worst part? You’ve become your own worst enemy—making decisions based on fear, shiny presentations, and fleeting validation rather than strategic thinking.

“Too Busy to Make Money”

This is the mantra of far too many pharmacy owners. You’re skeptical (good), but you’re also risk-averse and reactive (bad). You’re afraid to take bold steps, so you:

- Burn money on shiny tech portals that promise salvation but deliver peanuts.

- Throw cash at marketing, blogging, or data providers without checking for ROI.

- Fall for pilot programs pitched by buying groups or wholesalers, signing up for the “free trial” only to realize you’re now locked into paying like every other member.

You’re too busy to make money because you’re addicted to knowing everything. Your need to chase every piece of “knowledge” is like overloading your hard drive—it slows down the processor and keeps you from getting anything done.

Your skepticism isn’t serving you because it’s paired with desperation. You say no to the right opportunities because they feel risky, and you say yes to the wrong ones because they feel easy.

The Stage Time Trap: Chasing Ego, Not Results

How many times has someone asked for your “expert opinion,” and you’ve jumped on a plane, on your dime, for 15 minutes of stage time?

It feels good, doesn’t it? People clapping, nodding at your wisdom. But here’s the harsh reality: that applause doesn’t pay the bills. While you’re chasing ego boosts, your pharmacy is sitting in the red.

You’re spending money and time that could have been invested in growth, staff training, or process improvements—all for a fleeting moment in the spotlight.

- You get dazzled by colorful slides in a presentation but fail to ask, “How exactly will this work for my business?”

- You hear glowing testimonials but don’t dig deeper: “What’s in it for this reference? Is their opinion biased?”

- That new marketing tool you don’t need?

- That podcast that you appeared in and are sharing nonstop with your family, friends, and colleagues?

- A VP or exec from your wholesaler or buying group drops by your pharmacy, and you feel honored. But ask yourself: Why are they here? What are they selling? And how does this serve my bottom line?

- While at the conference, you are probably invited to a dinner by your PSAO, a Vendor, or your wholesaler (if you are worthy enough); now you have lost more time that you could have spent in building relationships with some equal or higher caliber people.

A software vendor asks for your "expert advice," and off you go—flying on your dime again because they flattered you a little. Did it ever occur to you to ask for a cut of their earnings if they use your brilliant ideas? Or are you just happy with the free kisses?

The Fear of Initiative: Sitting on Your Hands

Let’s address the elephant in the room. Many pharmacy owners are sitting on their asses. There’s no nice way to say it.

- Risk Aversion: You’re terrified of taking calculated risks, even when the data supports them. You’d rather maintain the status quo than explore a new revenue stream that could double your profits.

- Paralysis by Analysis: You overthink every decision to the point of inaction. Opportunities pass you by while you’re busy debating.

- Shiny Object Syndrome: Your initiatives are often driven by flashy presentations and promises, not strategy or need.

So, who’s going to save your business? Look in the mirror. It’s you—or it’s no one.

Where Is Your Money?

Let’s get real: money is everywhere. It’s in your business, hiding in plain sight. The problem isn’t that the money doesn’t exist—it’s that you’re not prioritizing it correctly, prioritization isn’t just a buzzword—it’s your lifeline.

Here’s the secret: Change the delta between Gross Receipts (Accounts Receivable) and Gross Payables (Expenses)—immediately.

Step 1: Chase Higher-Profit Ventures

You need ventures that complement your existing pharmacy business and generate higher margins. Start here:

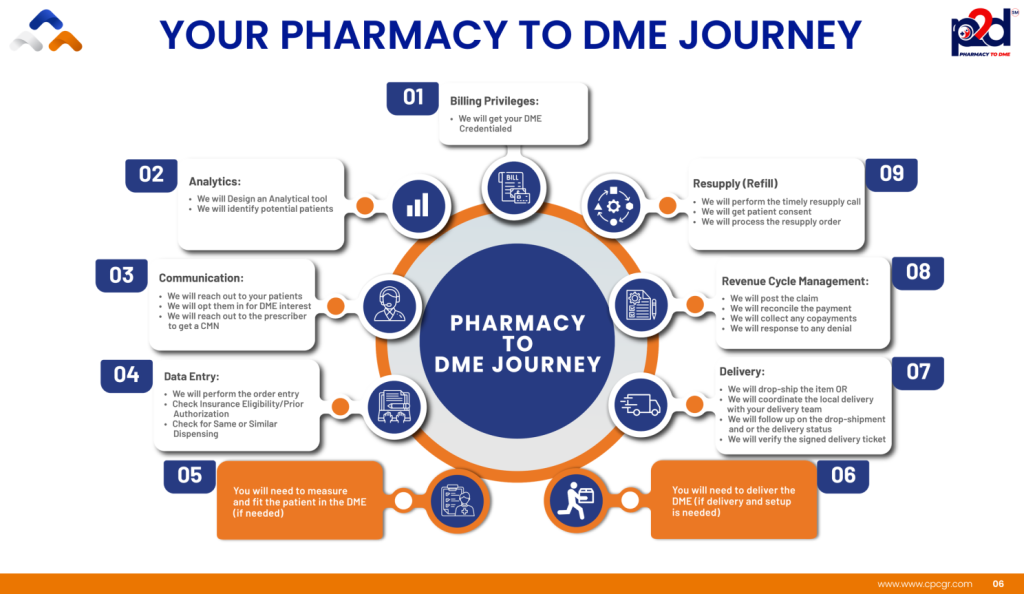

- DME and Medical Supply Ventures Durable Medical Equipment (DME) and medical supplies are goldmines waiting to be tapped. About one-third of your patients either use or qualify for DMEs and medical supplies. Why are they getting these from a “true” DME company and not from you? Because they don’t think you’re capable of delivering. Fix that perception. If you had established that, then you would still lose money on the retail, but now you are treating the patient as an anchor, the anchor which is going to get you a profitable product to dispense – the overall result must be a positive profit, a really positive one.

Reality Check: Don’t think test strips. True DMEs don’t bother with them—there’s no money in it. Focus on profitable products that make sense for your patient base.

Pro Tip: Don’t dive into this without backing. Partner with a solid, experienced firm that knows the ins and outs of DME credentialing, contracts, distribution, and revenue cycle management.

- Private Pay (OTC Sales) are fantastic for increasing your margins and offsetting payroll costs.

Why OTC Sales Matter:

- No recoupment nightmares.

- Higher gross profits.

- Endless upsell opportunities.

How to Succeed in OTC Sales:

- Dedicated Personnel: Assign a staff member solely to OTC sales.

- Smart Merchandise Selection: Don’t stock items that are easily found at Walmart or Amazon—unless it’s a big-name brand patients trust.

- Do not let the consumer find the OTC product you are selling in a few seconds on the web. It must be exotic enough not to be found easily.

- Higher Prices: Yes, you read that right—charge more. Your competitors can’t offer the same personal touch and convenience.

Challenges to Watch For:

- Dedicated personnel are expensive, and many owners quit halfway due to cost concerns.

- If you try to have your pharmacy techs juggle pharmacy work and OTC sales, both areas will suffer.

Solution:

- You can use an experienced technology firm to build analytical tools that tag potential OTC patients from your existing database.

- Employ a highly affordable, dedicated offshore resource focusing exclusively on OTC sales—advising patients, upselling, and even processing payments virtually.

Step 2: Cut Labor Costs—Smartly

Labor is your most significant expense—and your most enormous opportunity for savings. Let’s break it down:

- Revenue: $5,000,000 annually.

- 2% Reduction in Labor Costs: $100,000 saved.

- 3% Reduction in Labor Costs: $150,000 saved.

- 4% Reduction in Labor Costs: $200,000 saved.

But here’s the problem: Labor costs in your region are fixed by the market. You’re not going to suddenly find local talent willing to work for less.

The Solution: Go global. Global labor is your new cost of goods sold (COGS). Outsourcing doesn’t mean cutting corners—it means finding the same or better quality for a fraction of the cost.

The Hard Truth

During this newsletter, I may have made some enemies. But unlike you, I’m not stuck in this mess—I’ve already built healthcare groups and global business process offshoring firms, and I have moved on. My only goal is to highlight what you’re not seeing because you’re too deep in the weeds.

This isn’t about luck. It’s about action. So, stop sitting on the sidelines and start prioritizing what matters.

Thank you for reading, and good luck—if luck is what it takes.

Saleem Shah

Saleem Shah is the Founder of Collaborative Patient Care Group (CPCG), a visionary organization that empowers businesses to optimize their operations and achieve global competitiveness through strategic offshoring and workforce evolution. With a background as a pharmacist turned entrepreneur, Saleem brings a unique perspective and unwavering commitment to transforming human capital management. His innovative ‘Fragmentation Rule’ approach has helped countless businesses unlock their full potential by leveraging the power of global talent while simultaneously elevating their onshore workforce.